Rates

View Rates Disclaimers

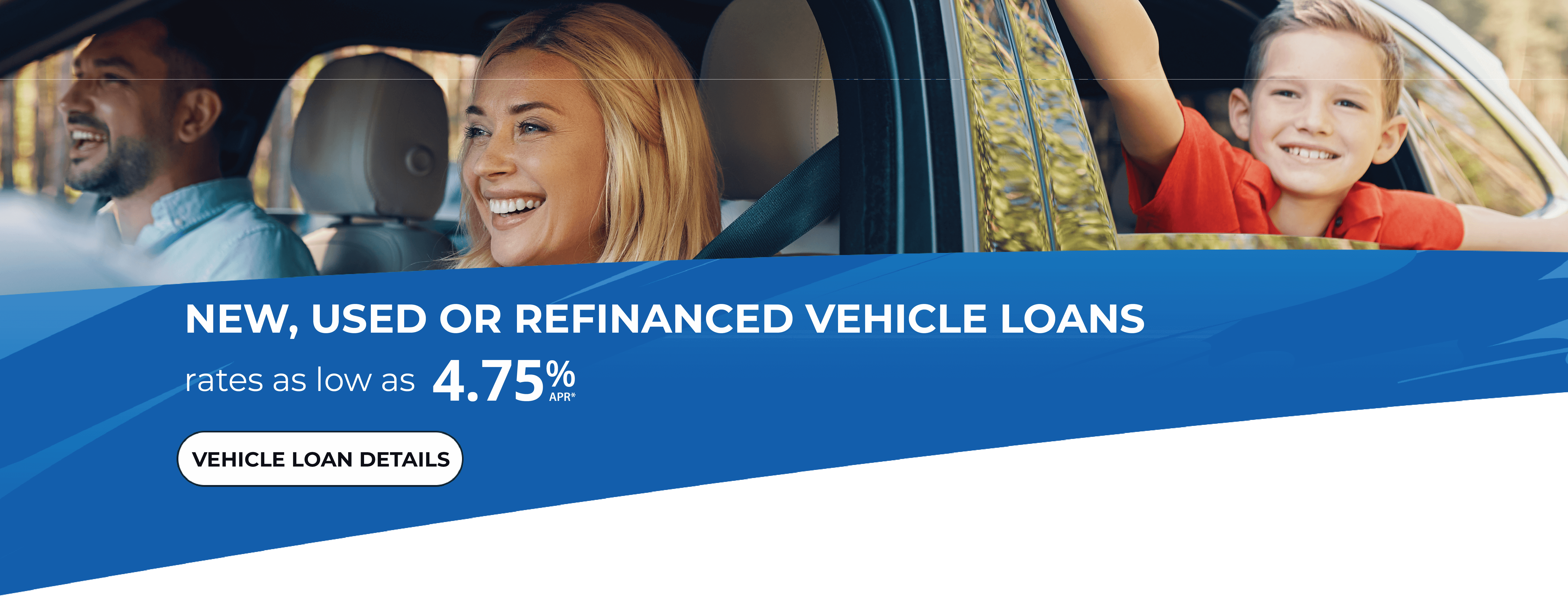

All loan rates apply to 'new money' borrowed only (not the refinance of existing loans at County-City Credit Union). Rates are subject to change at any time.

*APY = Annual Percentage Yield. Rates subject to change any time without notice. Fees may reduce earnings on the account.

**APY = Annual Percentage Yield. Penalties apply for early withdrawal. Rates subject to change any time without notice. Fees may reduce earnings on the account.

1 APR stands for Annual Percentage Rate. Rate is determined by adding a 2.00% margin to the related deposit account rate.

2 APR stands for Annual Percentage Rate. Rate is based on credit score and term.

3 APR stands for Annual Percentage Rate. Rate is based on credit score and term. 72 month term available for vehicles 6 years old and newer.

4 APR stands for Annual Percentage Rate. Rate is variable based on prime rate, plus a margin based on credit score, and can change every quarter, on the first day of the billing cycle immediately following the start of the new quarter, based on Prime Rate as posted in the Money Section of the Wall Street Journal on the first day of the quarter. Prime Rate as of 10/01/2023 was 8.50% APR. The APR is the same for cash advances and balance transfers. There is a 25-day grace period to avoid a finance charge on a purchase.

5APR stands for Annual Percentage Rate. Rate is variable based on prime rate plus a margin of 8.50%. The rate can change on the first day of every month, based on the prime rate as published in the Wall Street Journal’s Money Rate Section on the last day of each month.

6 APR stands for Annual Percentage Rate. Rate is variable tied to prime rate. The rate can change on the first day of every month, based on the prime rate as published in the Wall Street Journal’s Money Rate Section on the last day of each month.

-

Doug H.

County city is an awesome credit union unlike anywhere else I have ever banked, they have actually come out to my house to do loan paperwork due to my work schedule. Now that is love.

In the Community

We are actively involved in supporting the growth and quality of life in our community. We support local organizations by making donations of time, talent and money. We offer support and encouragement to worthy causes.

Amount Donated

$7,035

Hours Volunteered

194

(During 2024 Calendar Year)

Membership Eligibility

- Jefferson County

- The City of Watertown

- The City of Whitewater; or

- The Village of Cambridge

OR

- Spouse

- Parent or Step-Parent

- Child or Step-Child

- Grandparent

- Grandchild

- Sibling

- Other relative residing in the same household